5. Continuation Setup (CT)

[1. Setup Mastery] - [1.3 Bullish Setup] - [1.3.1 Momentum Burst (MB)] - [1.3.1.2 Continuation Setup (CT)]

1. Logic & Understanding

Here the consolidation period is very short. That is a short period of sideway action that is in a few days.

Consolidation should be 3 to at best 10 days of sideway action or pull back. The good ones have 3 to 5 days.

And if consolidation becomes longer like more than 10 days and breaks out without high volume then it fails.

Check list criteria is 2Lynch.

This setup has the highest probability and highest win rate. There is a lot more information in the first leg of buying we know.

Continuation setups happen more than 1000 times a year. Continuation setups happen continuously.

We can almost find 2-3 setups in a day in the bull market even in a short term rally in a bear market. And if we are seeing more than 10 setups then selection is not up to the mark.

This is number 1 strategy so make this work.

Sequence of things for mastery is first continuation setup then consolidation setup then bottom bounce.

Mastering this is absolutely necessary and it's simple too with simple rules.

Continuation setup has more probability than consolidation then bottom bounce setup.

2. Pre-Requisite’s

Find 2nd or 3rd leg after that it tends to fail. Sometimes 4th and 5th leg work? Yes. Probability of 4th and 5th leg working is much lower.

On breakout day or range expansion day the stock should close near high. If not, That means there is no momentum.

The day before the breakout it should be either negative day or small up move more like 0.5% and much more like a tiny range bar.

Stock should not be up 2 days in a row before breakout or start of the swing.

Important - To achieve a high win rate, Consolidation quality is the single biggest factor if this is going to work or not.

For good consolidation quality it should be less than 10 days. Best one ranges from 3 to 7 days and if it's more than 10 days then it needs a high volume breakout to work.

And if consolidation is choppy and has one 4% breakdown it's okay can be traded more than one then it's no go setup and that one 4% down day should have less volume.

Volumes of consolidation days should go down in the direction of consolidation.

Important - 1st leg should have persistent buying that is without gaps. Quality of consolidation should not have any selling or no selling that is 3 to 7 days. And the quality of breakout and this breakout should close near the high of the day.

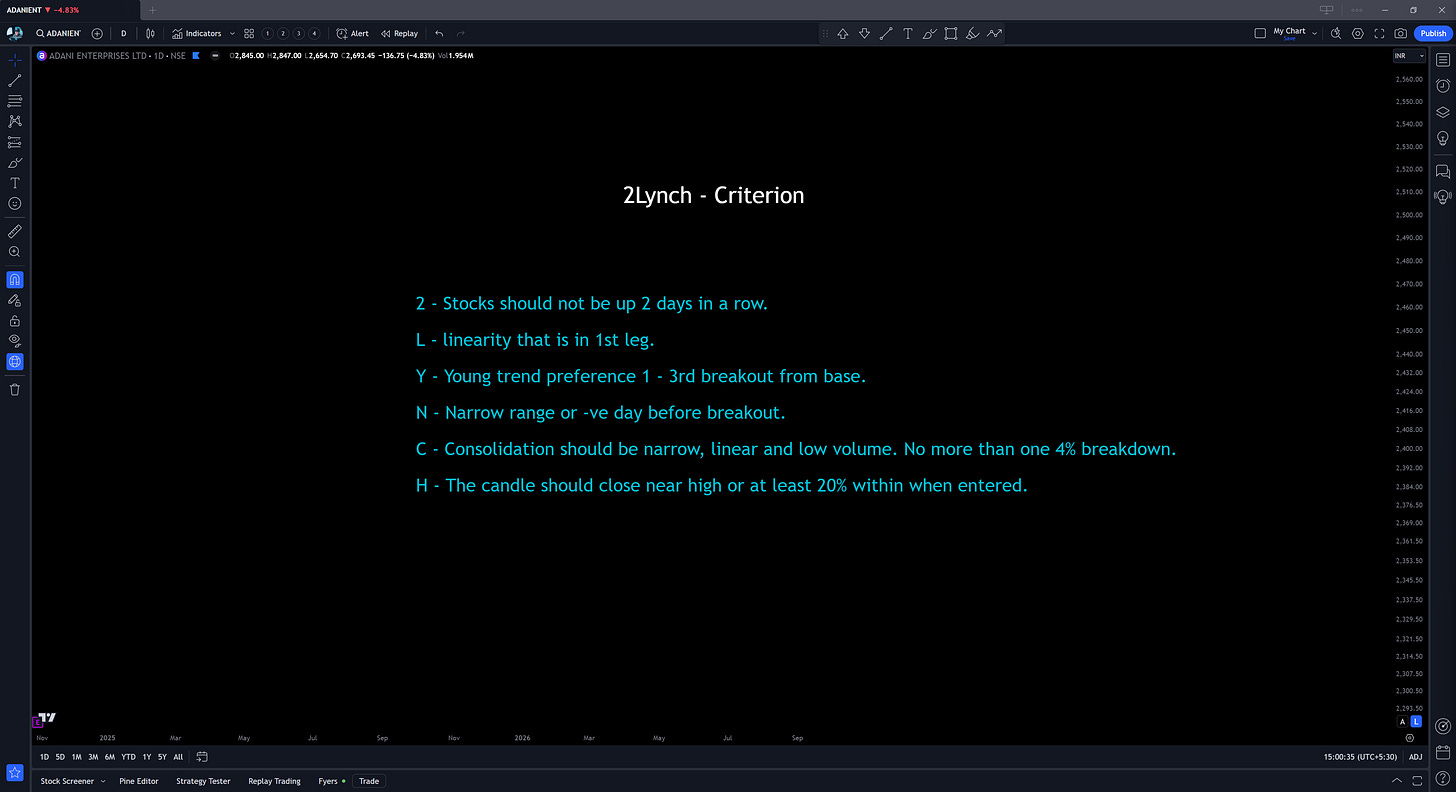

Checklist for this is 2LYNCH.

2 - Stocks should not be up 2 days in a row.

L - Linearity that is in 1st leg.

Y - Young trend preference 1 - 3rd breakout from base.

N - Narrow range or negative day before breakout.

C - Consolidation should be narrow, Linear and low volume. No more than one 4% breakdown.

H - The candle should close near high or at least 20% within when entered.

3. Nuance

If 3Q is in control then it results in a high win rate.

To catch 20% move, hunt for a continuation setup which has 20% and more moves in the first leg and then it has a high probability that the 2nd leg will have 20% move. And usually, the 2nd leg will have less than the 1st leg.

4. Process

Run a combo bullish scanner to find these. Every single continuation setup that is 2LYNCH will show up in this scanner. Scan it from 9:30 to 4:00. Most of the time you will find 1 2 momentum bursts in the first half an hour if not scan till 4 PM.

Yeah I used

Now no problem

💪

Can you share the link 🔗 for Combo bullish scanner here Guruji ?