How To Spot a Real Guru Instead of Reel Guru for Trading! - Part 2

My Guru Pradeep Bonde aka Stock Bee

Guru should be very successful himself measure it in terms of money he made as it’s the most important thing. A proven track record.

Guru already should have produced money making machines.

Should share concepts more than the stock itself.

Has high win rate upwards of 50 - 60%.

Who posts rarely - If someone is posting daily it’s a red flag. I never seen Pradeep Bonde or KQ do that.

Public accountability – Shares live trades, broker statements, or verified Zerodha Console P&L regularly.

Risk-first mindset – Talks more about capital preservation than just profits.

Teaches process over tips – Helps you build your own system, not just spoon-feeding stock names.

Admits losses openly – Talks about bad trades and what went wrong—real traders know losses are part of the game.

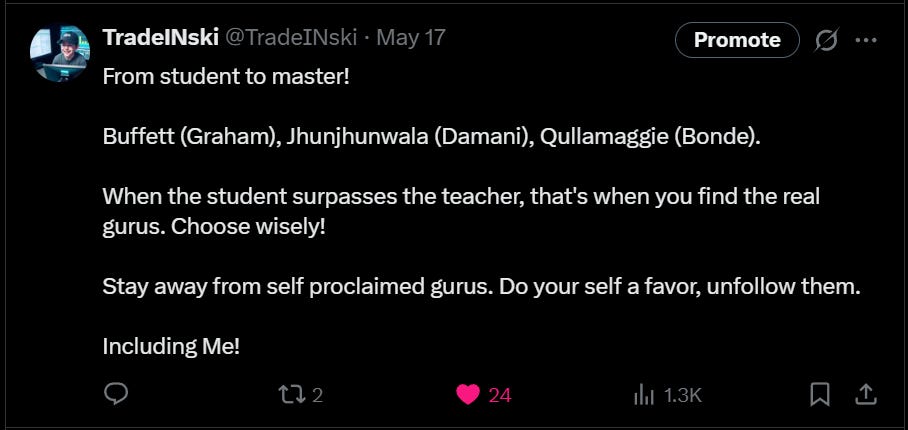

Keeps ego in check – Doesn’t act like a god or savior. Talks with humility and accepts flaws.

Focus on education, not hype – Emphasizes learning, journaling, and system building.

Long-term consistency – Shows steady growth over years, not just a few lucky weeks.

Supports critical thinking – Encourages questions, independent back testing, and strategy building.

Shares real tools – Gives useful insights like back testing methods, code, or trade setups—not vague advice.

Doesn’t chase followers – Has a small but strong community. Doesn’t try to go viral.